.png?width=1024&name=WLG_Webinar_FBLITW%20(1).png) On Friday April 24, WunderLand was proud to present an informative and timely webinar on how to navigate the unemployment system. COVID-19 has impacted many marketing professionals who find themselves needing to file for unemployment. How do you do this? What’s the new legislation? What can you expect? We explored all of this, and more.

On Friday April 24, WunderLand was proud to present an informative and timely webinar on how to navigate the unemployment system. COVID-19 has impacted many marketing professionals who find themselves needing to file for unemployment. How do you do this? What’s the new legislation? What can you expect? We explored all of this, and more.

Our guest speaker was Jorie Cummis, CEO of NSN Employer Services. NSH is a third-party unemployment administrator and they’ve worked with WunderLand for the past ten years, supporting us as we manage our own unemployment claims. Jorie started the webinar by giving us brief background on unemployment, a system that was initially formed to support workers and to help the country climb out of the Great Depression.

The unemployment system was set up as a federal program in which states administer benefits. Depending on which state you’re in, you might see different laws and systems, but generally, unemployment systems operate in the same way. State unemployment funds are fully funded by employers. Employers incur a payroll tax based upon a variety of factors, and those taxes are put into a fund at the state level.

Under Normal Circumstances

Normally, to receive unemployment benefits, an employee needs to meet a set of eligibility requirements. Employees often think they are eligible for unemployment in any case, but they do have to meet specific criteria.

First, an employee must be out of work due to no fault of their own. Many employees are falling into this category today as many employers have laid people of due to COVID-19.

Second, an employee usually must be able to work, available to work, and actively seeking work. Right now, many states have actually waived the “actively seeking work” requirement because so many companies are not hiring or hiring processes have stalled. Normally, you need to have proof and you need to show the state your work search records, the places you’ve applied, and interviews you’ve gone on. Although this requirement in many cases is now waived or states are being more lenient, you might still see these questions asked of you as you go through the unemployment process; not all states have updated their systems.

Circumstances Are NOT Normal Today

The Coronavirus Aid, Relief, and Economic Security (CARES) Act was passed by Congress and signed into law on March 27th, 2020. This over $2 trillion economic relief package is meant to protect American people from the public health and economic impacts of COVID-19. The CARES Act provides assistance for American businesses and our state and local governments. It also helps American workers by including provisions directly related to unemployment, such as:

Today’s Landscape

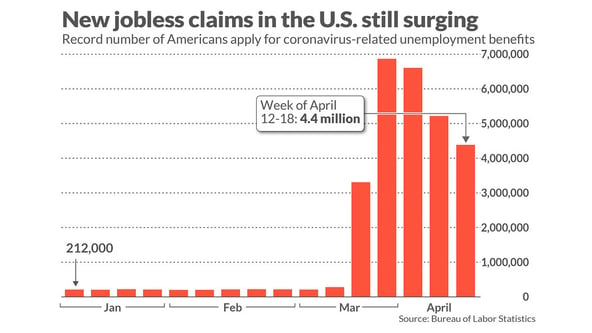

This graphic clearly illustrates the impact of COVID-19 on the unemployment system. Just a short couple of weeks ago, our entire country saw 200,000 claims per week. Last week, for one week alone, there were 7 million claims being processed. We’re seeing 1,000 times more claims in the last five weeks than the U.S. normally sees in an entire year. Additionally, most state unemployment systems were developed 30 years ago. They didn’t function exceptionally well in normal circumstances, and now they're trying to cope with unprecedented claims volume. Combine these factors and it’s clear to see the reasons behind the frustration many unemployed professionals are experiencing.

This graphic clearly illustrates the impact of COVID-19 on the unemployment system. Just a short couple of weeks ago, our entire country saw 200,000 claims per week. Last week, for one week alone, there were 7 million claims being processed. We’re seeing 1,000 times more claims in the last five weeks than the U.S. normally sees in an entire year. Additionally, most state unemployment systems were developed 30 years ago. They didn’t function exceptionally well in normal circumstances, and now they're trying to cope with unprecedented claims volume. Combine these factors and it’s clear to see the reasons behind the frustration many unemployed professionals are experiencing.

Tips for Managing the Process

You must be patient with the system right now. States are completely overwhelmed. They’re not staffed appropriately and while states are quickly trying to add more staff, those who normally handle phone calls are often redeployed to processing claims.

You will see long wait times, if you even get hold of anyone at all. You will probably have to make multiple calls to get through if you’re trying to reach your state unemployment office. Some people have told us they have the most success by calling right when the unemployment offices open.

Take heart. You might think no one is hearing you or listening to you, but they will get to you.

File your claim as soon as you possibly can. The only way you can file right now is online; you can no longer go into an unemployment office. Understand that you might get kicked out of the system; once again, be patient. Finally, make sure you answer each question as completely and accurately as possible. Even one incorrect or incomplete answer could delay the processing of your claim. Also, many states have established specific dates for filing based on your last name. Check with your individual state.

Be sure to check state unemployment websites for additional information. (Illinois, California, New York, Connecticut). You should also follow your state on Twitter, where they are often posting updates (Illinois, California, New York, Connecticut).

Finally, there are Facebook support groups where you can get pointers from others and read about others experiences (examples here and here).

In Closing

Thank you to Jorie Cummis, our speaker, for your valuable subject matter expertise. The recording of our session is available here.

If you’re actively seeking a new position in marketing, be sure to join WunderLand’s Talent Community and explore our current job openings. We still have many clients who are hiring and we’d love to help as many as we can.

Thank you, and stay healthy!